NEWS & INSIGHTS

SHARE. MEET. EXPAND.

Events

News & Insights

-

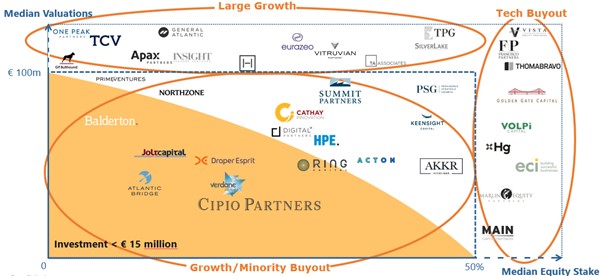

November, 2025Europe has made huge progress in technology investing, showing 10x growth in investment levels over the past decade..

-

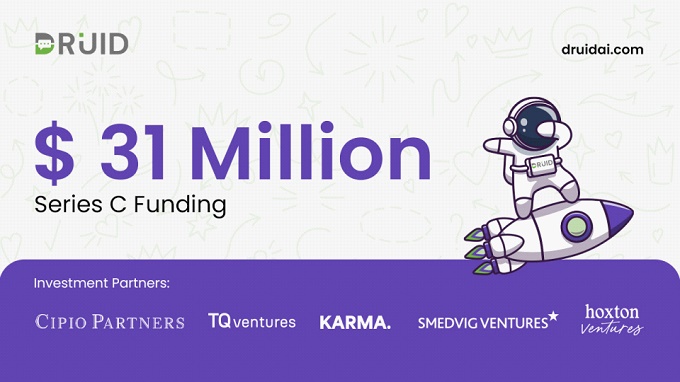

September, 2025Munich/Luxembourg– September 16, 2025 –Cipio Partners leads a USD 31 million Series C investment round into Druid AI…

-

July, 2025Munich/Luxembourg, July 8, 2025 – The deep-tech company Hololight, a leading provider of AR/VR ("XR") pixel-streaming technology, has secured a €10 million investment.

-

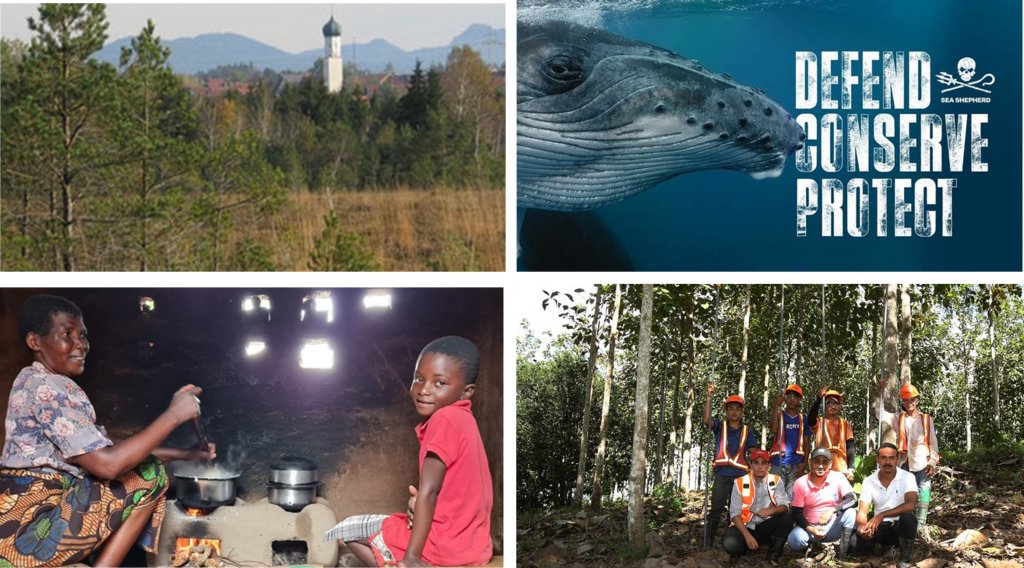

May, 2025Since 2021 we have actively worked to reduce our greenhouse gas emissions (GHG) and offset any unavoidable emission through compensation projects....

-

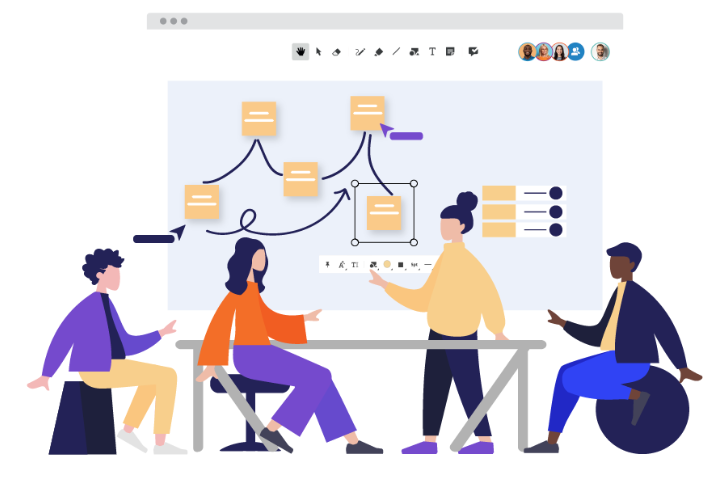

March, 2025Munich/Luxembourg – March 19, 2025 – Cipio Partners invests 10 million euros in Conceptboard....

-

December, 2024Since 2021 we have actively worked to reduce our greenhouse gas emissions (GHG) and have chosen to offset any unavoidable emissions by supporting four sustainability projects each year...

-

September, 202410 years ago, we sold our first software company to a private equity fund...

-

June, 2024Munich/Luxembourg – June 5, 2024 – AI-Powered Swedish Sport-Tech Spiideo raises $20 Million In Growth Round Led By Cipio Partners...

-

May, 2024Munich/Luxembourg – May 30, 2024 – The latest funding round enables FintechOS to accelerate global expansion...

-

May, 2024Munich/Luxembourg – May 23, 2024 – Cipio Partners is pleased to announce the appointment of Nils Matthies as Principal...

-

April, 2024Munich/Luxembourg – April 11, 2024 – Cipio Partners is pleased to inform about the strategic partnership of its portfolio company Wire and Schwarz Group...

-

March, 2024Munich/Luxembourg – March 4, 2024 – Cipio Partners has completed the sale of its portfolio company, Silicon Mobility SAS, to Intel Corp...

-

January, 2024Munich/Luxembourg – January 22, 2024 – Welcome to the Jungle, the leading French employer branding and recruitment platform, has announced the successful acquisition of London-based Otta...

-

January, 2024Munich/Luxembourg – January 10, 2024 – Cipio Partners is pleased to announce the promotion of Thomas Lenz and Endric Mueller to Senior Associates...

-

January, 2024Munich/Luxembourg – January 08, 2024 – Lectra (Euronext: LSS) announced the acquisition of Cipio Partners portfolio company Launchmetrics...

-

October, 2023The global industrial software market was valued at US$92.58 billion in 2021, 16.1% of the overall global software market in that year...

-

July, 2023MICROOLED, the leading manufacturer of high resolution, low power consumption OLED microdisplays, announces a €21 million fundraising...

-

June, 2023It took European technology well over a decade to rise from the ashes of the internet bubble...

-

June, 2023European technology investment only appeared on the map in the late 90s...

-

June, 2023Since 2021 we have actively taken steps to reduce our CO2 emissions...

-

May, 2023ChatGPT has made the power of Artificial Intelligence ("AI") and Machine Learning ("ML") both visible and easily accessible...

-

January, 2023Munich/Luxembourg – January 23, 2023 –Welcome to the Jungle raises €50 million to further expand in Europe and the US...

-

December, 2022Munich/Luxembourg – Dec.13, 2022 – Cipio Partners portfolio company Zappi, the leading consumer insights platform designed for creators...

-

October, 2022History bears witness to the destructive potential of unplanned succession...

-

September, 2022Munich/Luxembourg – September 12, 2022 – Cipio Partners hires Thomas Lenz as Associate...

-

August, 2022Munich/Luxembourg – August 15, 2022 – Cipio Partners leads a €24 million growth round along existing investor Iconical...

-

May, 2022Munich/Luxembourg – Mai 30, 2022 – Cipio Partners announces that it has promoted Dr. Ansgar Kirchheim...

-

May, 2022Munich/Luxembourg – May 4, 2022 – Cipio Partners, a leading investor in European growth stage technology firms, has closed its latest fund, Cipio Partners Fund VIII, with €202 million in commitments...

-

April, 2022Munich/Luxembourg – April 25, 2022 – Cipio Partners announces the sale of its portfolio company Blackwood Seven to Kantar...

-

March, 2022Launchmetrics acquires its main competitor, DMR, strengthening its data and analytic capabilities...

-

January, 2022In 2021 we have actively taken steps to reduce our CO2 emissions and we have decided to offset the amount of CO2 which we can’t avoid through 4 sustainable projects...

-

December, 2021Munich/Luxembourg – December 22, 2021 – Cipio Partners announces the sale of its portfolio company Brightpearl to Sage...

-

December, 2021Munich/Luxembourg – December 17, 2021 – Cipio Partners Fund VII’s portfolio company Vitafy announced that it was combining forces with EVP Group, a leading player in the European consumer healthcare market...

-

December, 2021Munich/Luxembourg - December 7, 2021 – NavVis adds €25m in fresh funding to fulfill its mission to digitize commercial buildings and assets...

-

November, 2021The merits of investments in Deep Tech startups are significant, yet the challenges posed to investors navigating the space are also considerable. Cipio Partners breaks down the rules of the space for growth investors...

-

September, 2021Technology companies are increasingly defining capital and labour markets. In the past, Europe has been watching from the sidelines, but European Scale-Ups are poised to reverse that trend....

-

August, 2021Munich/Luxembourg – August 06, 2021 – Cipio Partners participates in € 20m growth round...

-

June, 2021Munich/Luxembourg – May 28, 2021 – All EyeEm Group shareholders including Cipio Partners sign agreement to sell the global premium stock photography marketplace to New Value AG (SIX Swiss Exchange: NEWN).

-

April, 2021Cipio Partners invests in « La Ruche Qui Dit Oui ! » the iconic leader of the farm-to-the-table movement in Europe. Launched in 2010, « La Ruche Qui Dit Oui ! » is an innovative online food marketplace ...

-

March, 2021European Growth PE is maturing and a segmentation has emerged: European Growth PE exists at the intersection of venture capital and traditional private equity...

-

January, 2021Munich/Luxembourg – January 11, 2021 – Cipio Partners announces that Dr. Ansgar Kirchheim, a former Partner of High-Tech Gründerfonds, has joined the firm’s investment team...

-

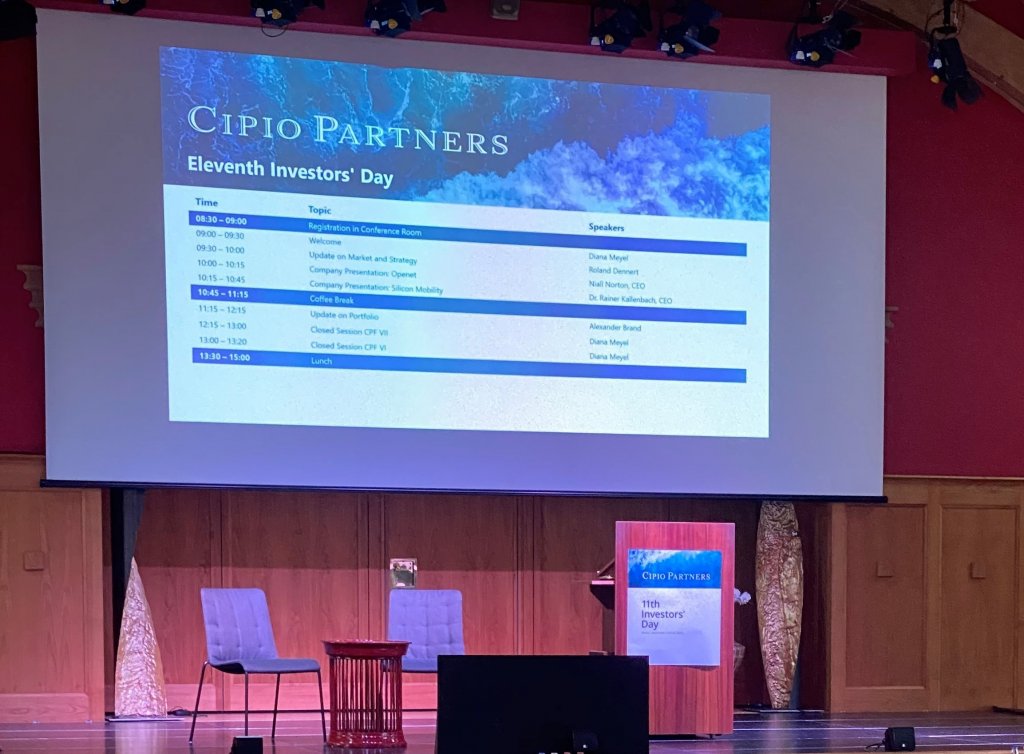

November, 2020These were some conclusions when, in September 2020, we were privileged to spend 1.5 days off-site and in person with many of our limited partners...

-

September, 2020Munich/Luxembourg – September 7, 2020 – Cipio Partners participates in a EUR 8 million growth round along with Ventech...

-

July, 2020Munich/Luxembourg – July 23, 2020 – Cipio Partners announces the sale of its portfolio company Openet to Amdocs. The sale marks the 2nd exit of a portfolio company from Cipio Partners Fund VII...

-

July, 2020Munich/Luxembourg – July 21, 2020 – Cipio Partners, announces the sale of its portfolio company DisplayLink to Synaptics...

-

April, 2020No one can tell yet what the impact of Covid-19 on our health, our society and our economy will be. Without doubt it will have a tremendous impact on European technology. However, we believe companies and investors will emerge stronger than before...

-

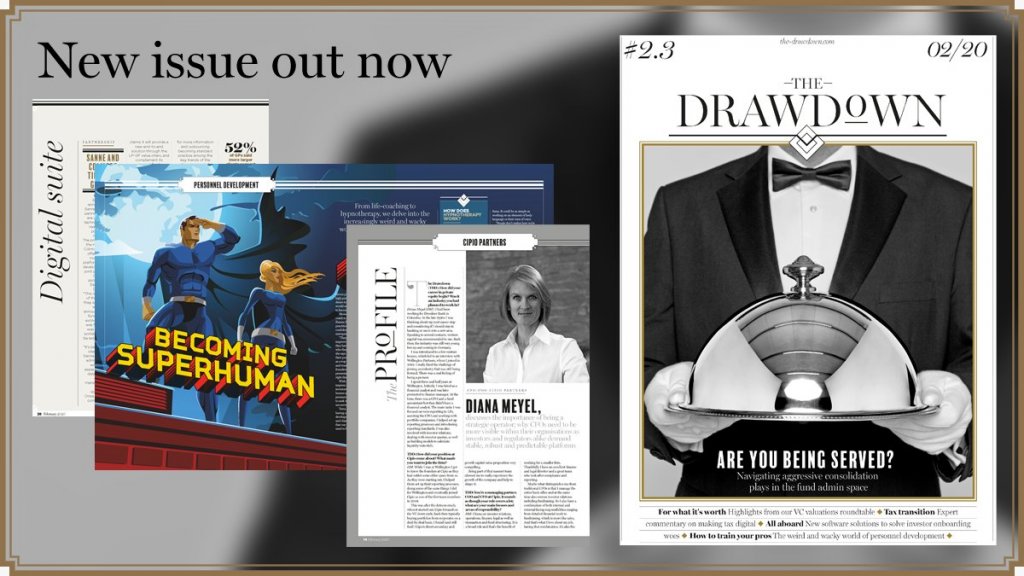

February, 2020Cipio's Meyel discusses the importance of being a strategic operator; why CFOs need to be more visible within their organisations as investors and regulators alike demand stable, robust and predictable platforms...

-

January, 2020The US funds’ foray into Europe is in full swing as Pitchbook’s data shows: Participation of US funds in European venture deals has grown from 8% in 2010 to 17% for early-stage deals and 23% for late-stage deals in 2019...

-

December, 2019The acquisition will expand Launchmetrics’ Brand Performance Cloud to allow brands to create inspiring, shareworthy and measurable experiences to help attract today’s modern consumer...

-

November, 2019In September 2019, French President Emmanuel Macron announced €5 billion for French start-ups. This has been unprecedented, but we believe it’s only the beginning of sustained growth of European technology investing...

-

October, 2019Diana Meyel, Managing Partner of Cipio Partners, shares the three things to keep in mind for women to trail a career in a Private Equity firm...

-

September, 2019Munich/Barcelona – September 25, 2019 – Cipio Partners leads a €5 million growth round along existing investors Active & BDMI...

-

September, 2019Munich/Paris/San Francisco – September 18, 2019 – Cipio Partners participates in a €16.5 million growth round along Hi Inov and Entrepreneur Venture…

-

September, 2019In 2003, when Cipio Partners started investing we pioneered in Europe what was soon called secondary direct transactions. Today, we feel we have established a new level of liquidity into a formerly illiquid asset class…

-

August, 2019Interview mit Diana Meyel und Roland Dennert, Cipio Partners: Im Buyout-Sektor reichen sich Private Equity-Gesellschaften in schöner Regelmäßigkeit Portfoliounternehmen weiter...

-

February, 2019Munich/Luxembourg – February 25, 2019 – Cipio Partners invests in ZappiStore a leading market research automation platform & analytics solution for the consumer product industry. Zappi has developed a platform to automate…

-

December, 2018Munich/Luxembourg – December 13, 2018 – Cipio Partners leads EUR 10 million financing round in Munich-based VITAFY, one of the leading providers of nutrition and dietary supplements for fitness, weight management and health…

-

October, 2018Luxembourg/Sophia Antipolis/Oakland – October 11, 2018 – Cipio Partners and Capital-E jointly structured a US$10 million growth financing alongside undisclosed private industry investors to enable Silicon Mobility to meet its ambitious…

-

September, 2018Munich/Luxembourg – September 05, 2018 – Cipio Partners invests in Launchmetrics a leading marketing platform & analytics solution for fashion, luxury and cosmetics brandsLaunchmetrics, founded in 2016, is the leading marketing platform…

-

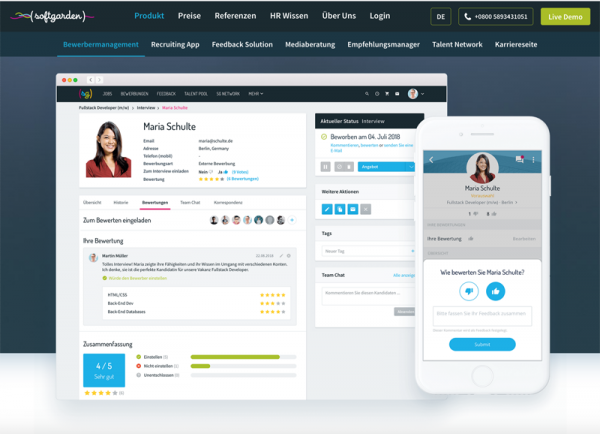

September, 2018Munich/Luxembourg – September 03, 2018 – Cipio Partners, announces the sale of its portfolio company softgarden e-recruiting GmbH to Investcorp. The sale marks the 29th exit of a Cipio portfolio company from Cipio Partners Fund VI.softgarden…

-

July, 2018Munich/Luxembourg – July 26, 2018 – Cipio Partners leads US$15 million growth round along existing investors Notion Capital and MMC in Bristol-based Brightpearl Ltd.Cipio Partners announces that it is leading a US$ 15 million growth round…

-

June, 2018Munich/Luxembourg – June 05, 2018 – Cipio Partners invests in Blackwood Seven: media planning powered by artificial intelligenceCipio Partners buys a secondary position in Blackwood Seven and invests into the latest growth round…

-

May, 2018Munich/Luxembourg – May 15, 2018 – Cipio Partners announces that Alexander Brand, the former CEO of Windeln.de SE, has joined the firm’s investment team.Cipio Partners buys a secondary position in Blackwood Seven and invests into…

-

July, 2017Munich/Luxembourg, July 3, 2017 – Cipio Partners, a leading European secondary direct and growth capital investment firm, has closed its latest fund Cipio Partners Fund VII SICAR with €174 million in commitments. The successful fundraise…

-

March, 2017Rotterdam/London, March 13, 2017 – Sustainable energy company Eneco Group has acquired a minority interest in UK-based data analytics company ONZO, as announced by both companies today. This investment strengthens…

-

January, 2017London/Munich/Dallas/Singapore – January 25, 2017 – tyntec, a global cloud communications provider, today announced that it has secured the backing of new investor Cipio Partners and that it has regrouped all its regional operations…

-

November, 2016Munich/Luxembourg – November 14, 2016 – Cipio Partners, a leading European secondary direct and growth capital investment firm, announces that it has completed the sale of its portfolio company, 1-2-3.tv to ARCUS Capital, a Munich…

-

August, 2016Munich/Luxembourg – August 16, 2016 – Cipio Partners, a leading European secondary direct and growth capital investment firm, announces that it has entered into a definitive agreement for the sale of its portfolio company…

-

January, 2016Munich/Luxembourg – January 11, 2016 – Cipio Partners, a leading European direct secondary investment firm, and co-investors announce the sale of its portfolio company, Cint AB, to Nordic Capital. Cint AB, headquartered in Stockholm…

-

August, 2015Luxembourg – August 17, 2015 – MyOptique Group, a Cipio Partners portfolio company specializing in online eyewear retail, has acquired German eyewear business 4Care and UK premium online eyewear business Eyewearbrands…

-

April, 2015Munich/Luxembourg – April 8, 2015 – Cipio Partners, a leading direct secondary investment firm, announced the closing of the sale of its portfolio company, Ipanema…

-

October, 2014October 7, 2014 – “Exit activity in the technology market has been subdued over the past few years, owing to a decline in European trade sales,” according to Cipio Partners managing partner Roland Dennert, speaking at the DACH Private…

-

September, 2014As more funds approach the end of their lives, these single-asset deals represent a growing opportunity for secondaries players, says Diana Meyel, a managing partner at Cipio.“In today’s environment, people think of secondary…

-

August, 2014France’s FCPI fund model is undergoing a needed evolution, with the market consolidating and regulation becoming more favourable – and these changes could be opening up a new avenue for direct secondaries. Ellie Pullen reports…

-

July, 2014“European technology companies are providing increasing opportunities for secondaries investors”, says Roland Dennert, a managing partner at Cipio Partners. Europe is home to an enviable array of up-and-coming venture-backed…

-

June, 2014MyOptique Group, Europe’s leading online optical retailer, today announced it has secured £16 million (€20 million) additional investment, bringing the total raised in its current Series C funding round to £35 million (€43 million)…

-

February, 2014February 10, 2014 – Cipio Partners, a European secondary direct investment firm, has announced the promotion of Christoph Wedegaertner to Partner.Christoph joined Cipio Partners in 2005 prior to which he managed the private…

-

February, 2014February 3, 2014 – The European single secondary direct market for technology firms has been valued at €1 billion per annum, according to in-house research conducted by Cipio Partners. A total of 60 deals per annum were tracked in 2012 and…

Roland Dennert

Roland is a Managing Partner. He is located in Munich and is responsible for both new investments and portfolio management since 2005. He started his private equity career at 3i Group doing technology and mid-market buyout deals. Before 3i, Roland was a strategy consultant with Roland Berger and The Boston Consulting Group in Paris, as well as a robotics engineer with Hitachi Ltd. in Japan.

Roland holds an MBA from MIT Sloan School of Management and a Master of Electrical Engineering from ETH Lausanne, Switzerland.

Roland Dennert

Roland is a Managing Partner. He is located in Munich and is responsible for both new investments and portfolio management since 2005. He started his private equity career at 3i Group doing technology and mid-market buyout deals. Before 3i, Roland was a strategy consultant with Roland Berger and The Boston Consulting Group in Paris, as well as a robotics engineer with Hitachi Ltd. in Japan.

Roland holds an MBA from MIT Sloan School of Management and a Master of Electrical Engineering from ETH Lausanne, Switzerland.

Roland Dennert

Roland is a Managing Partner. He is located in Munich and is responsible for both new investments and portfolio management since 2005. He started his private equity career at 3i Group doing technology and mid-market buyout deals. Before 3i, Roland was a strategy consultant with Roland Berger and The Boston Consulting Group in Paris, as well as a robotics engineer with Hitachi Ltd. in Japan.

Roland holds an MBA from MIT Sloan School of Management and a Master of Electrical Engineering from ETH Lausanne, Switzerland.

Diana Meyel

Diana is a Managing Partner and the company’s COO as well as a Manager to our Luxembourg entities. She is located in Munich and leads our funds’ operations and investor relations. Diana also oversees transaction structuring and represents Cipio Partners on the board of selected portfolio companies. Furthermore, she fulfils the role of Vice-Chair of the Invest Europe Professional Standards Committee. Prior to joining Cipio Partners in 2004, Diana was a Finance Manager at Wellington Partners, the pan-European venture capital firm and worked as a Senior Risk Analyst for Dresdner Bank Group nka Commerzbank in Germany and Bogotá, Colombia.

Diana holds a degree in Banking Administration from Frankfurt School of Finance & Management.

TitleManaging Partner, Manager

LocationMunich, Luxembourg

Dr. Ansgar Kirchheim

Ansgar is a Partner. He is based in our Munich office and is responsible for both new investments and portfolio management. Before joining Cipio Partners in 2021, Ansgar was a Partner at High-Tech Gründerfonds (HTGF). Previously, he was a founder and CEO of a German deep-tech start-up. He started his career at ERGO Group.

Ansgar holds an economics Ph.D. from WHU – Otto-Beisheim-School of Management, Germany, and a Diploma in Physics from Humboldt University, Germany.