NEWS & INSIGHTS

News - September, 2018

Cipio Partners Exits softgarden to Investcorp

Munich/Luxembourg – September 03, 2018 – Cipio Partners, announces the sale of its portfolio company softgarden e-recruiting GmbH to Investcorp. The sale marks the 29th exit of a Cipio portfolio company from Cipio Partners Fund VI.

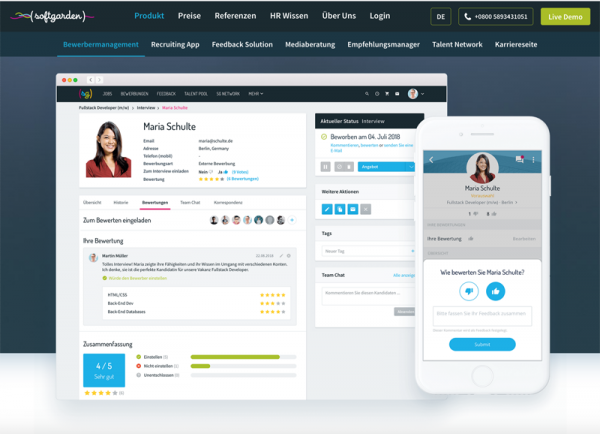

softgarden e-recruiting GmbH (“softgarden”) is a leading European Recruiting-as-a-Service provider with more than 400 corporate customers across a wide range of industries. softgarden offers an innovative recruitment technology platform to a diversified set of German midmarket and enterprise customers. The company’s “Applicant Tracking System” (ATS), a SaaS platform covering the entire digital corporate recruitment process, enables companies to streamline and manage their entire recruitment process in a fully automated and data-privacy compliant manner. In addition to this, softgarden offers a proprietary jobseeker market place with over 65,000 candidate profiles, as well as a tool allowing for the automated posting of job adverts on more than 300 job boards.

“We first bought out tired shareholders in an EBITDA negative company with a strong product and significant growth potential but still moderate scale”, said Werner Dreesbach, Managing Partner of Cipio Partners. “During our investment and based on an add-on acquisition, softgarden became a leading SaaS solution in the recruiting industry, tripled its revenues and reached profitability while Cipio became the company’s majority shareholder. We are very happy to pass the company into the hands of a leading PE firm to develop it further.”

Through selling softgarden, Cipio Partners has clocked its 29th exit from its fund Cipio Partners Fund VI. Previously, the fund has sold investments such as buyVIP to Amazon (NASDAQ: AMZN), Ipanema Technologies to Infovista S.A. (privately held by Thoma Bravo), 1-2-3.tv GmbH to ARCUS Capital, Cint AB to Nordic Capital and MyOptique Group to Essilor International.

Closing of the transaction is subject to customary anti-trust clearance.

Media contact

Sophie von Eberhardt: Ntym0bWVkaWFAY2lwaW9wYXJ0bmVycy5jb20=