NEWS & INSIGHTS

News - September, 2019

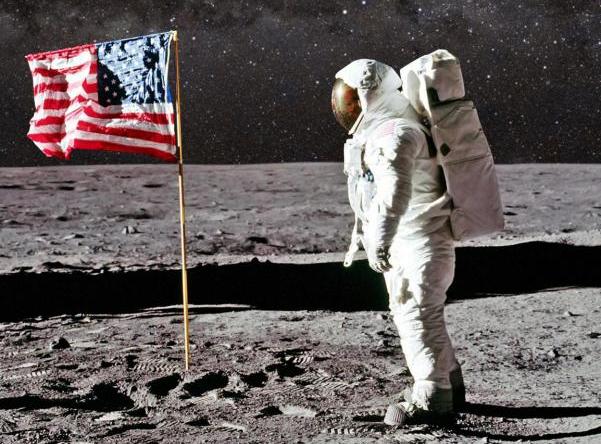

Mission accomplished.

In 2003, when Cipio Partners started investing we pioneered in Europe what was soon called secondary direct transactions. Today, we feel we have established a new level of liquidity into a formerly illiquid asset class.

From cradle to exit

In 2003, when Cipio Partners started investing, the prevailing attitude among tech investors was that fresh capital was to be used to grow the business, not to buy shares from existing shareholders. As a result, shareholders

of early and growth stage technology businesses had to stick around until the ultimate exit of the company. Once invested in a company one really didn’t have many liquidity options. The transaction cost, mostly in terms of the required discount to get a deal done, was just too high. For better or worse, you needed to see it through to the end: From Cradle to Exit.

Maybe, at the time, there were some good reasons for this: During the dotcom boom, companies were sold early and the time to liquidity was short. Generally, it did not take more than 3–4 years to exit and shareholders not being willing to wait that long really begged the question if anything was wrong with the business.

The market was, to quote a famous paper by George Akerlof, a market for “lemons”: Buyers would only offer deep discounts, assuming that the assets are troubled. Only the most desperate sellers, or the ones with the weakest assets, would still transact. This in turn only validated the negative preconceptions of the critical buyers.

But forcing shareholders who really wanted liquidity to stay put came with a price. They are weak supporters of their companies at best, would constrain access to capital, limit growth and eventually would force the entire company into an — often premature — exit. There needed to be a better way.

Secondary Directs

Secondary fund-of-funds such as Coller Capital, Lexington and others had started providing liquidity for fund investors in the mid-90s.

We saw the opportunity to do the same on the level of direct investments. A savvy buyer should be able to tell “lemons” from “peaches” by lowering the information asymmetry. An investor with deep experience in the space and a sufficient level of due diligence could look beyond the negative signaling of a willing seller. In Europe, Cipio Partners was among the first to bring this experience and skillset to the table.

The first transactions in the space were the acquisitions of venture portfolios from corporate VCs. This made a lot of sense as the decision maker for the sale, generally the CEO/CFO of the corporation, in fact knew a lot less than the buyer about the assets in question. We were able to pick the “peaches”, pay fairly and make a decent return.

Corporate portfolios really constituted only a small share of the asset pool and after a few years the portfolios worth buying had mostly been acquired. Portfolios owned by VC firms were a much larger asset pool. They should have been next.

However, the reasons that made corporate portfolios attractive targets also meant that portfolio purchases from VC firms never really took off in a big way. The sellers were too savvy about their own assets, tried to keep the “peaches” and sell the “lemons” for “peach-prices.” Only a few — sometimes disappointing — transactions happened. The market never really cleared.

Instead, a different model emerged: The GPs of these aging funds were happy enough to stay involved and to continue to collect fees. It was the LPs that really looked for liquidity. GP restructuring was the answer to this problem. The assets would be moved into a new fund, managed by the same GP, some LPs would exit and others would roll over into the new entity. The GP restructuring business is going from strength to strength.

Single Asset Direct Secondaries

For the companies concerned secondary purchases had proven beneficial. Growing holding periods put pressure on some shareholders to find early liquidity options. Enabling willing sellers to trade was a way to realign the syndicate around a business and valuation ambition and a timeline to exit. It was also a way to realign incentives that had become misaligned by excessive liquidation preferences and fund specific issues. Many growth stage companies need such buyouts of minority positions as much as they need fresh capital. We had found a new next niche in the market: systematically combining growth capital and minority buyout transactions.

While Cipio was approaching the market from one side, growth funds started to discover the opportunity from the other side. As growth funds were becoming bigger, they wanted to increase the size of a round by adding a few million Euros in secondary. Growth funds also became active participants in the market, albeit with a different focus.

The benefits of providing liquidity for early investors had become visible for everyone, the capital for such transactions was available and combining growth capital with such minority buyouts had emerged as the right structure. Today, we estimate that more than 50% of all larger, European growth rounds have a significant secondary element.

If our mission 15 years ago was to bring more liquidity in an illiquid asset class, we are today happy to say, “mission accomplished.”

Author: Roland Dennert