NEWS & INSIGHTS

News - September, 2021

Technology companies are increasingly defining capital and labour markets

The US and China dominate global business like never before thanks to their technology giants. However, Europe is growing technology scale-ups at a faster pace than ever. These firms are having a vital economic impact on shareholder value and employment throughout the continent.

China and America dominate global business like never before

Back in 2000, the promise of the single market and an impressive 41 of the world’s 100 largest companies made Europe’s international business eminence seem future-proof (1). Today, only 16 of the top 100 firms by market cap are European, while the US and China account for 76 of these.

The defining factor in this shift has been the ascendance of technology firms such as Amazon, Google and Facebook in the US and Tencent and Alibaba in China. Tech firms today comprise a quarter of the global stock market. The technological facility of the US and China accounts for their leadership in global business measured in shareholder value.

At least for the US, studies (2) show that the country only started to spawn large public companies at a higher rate than other sophisticated economies following the ERISA (3) reforms of the 1970s, which established minimum standards for pension plan investing in private capital and thus enabled the emergence of a large venture capital industry. This natural experiment suggests that the VC industry is causally responsible for the success of one sixth of the largest 300 US public companies. A comparable ecosystem has so far been lacking in Europe, and the natural result is the present position: only 3 of the top 50 largest tech companies in the world are European (4).

European tech advances faster than ever

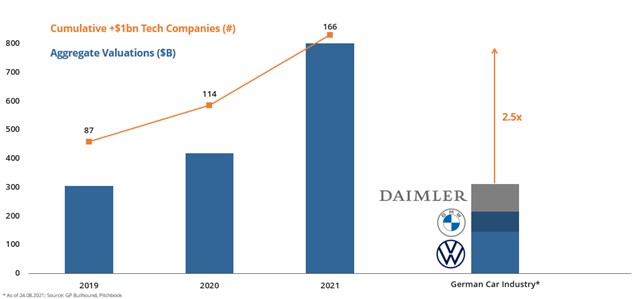

However, the current rankings belie the processes at work. 2020 saw €41bn invested in the European startup economy, six times the total only 10 years before, when the continent saw its first unicorn (5). Europe is home to 166 public and privately owned firms with a $1bn+ valuation, founded after 2010 (6). The number is rising rapidly, with meteoric rises such as Munich-based Celonis — now Germany’s most highly valued private scale-up. It would be short sighted to deny that today Europe increasingly hosts the right conditions for new firms to grow to scale, or that there is an absence of disruptive spirit.

Scale-ups are having a crucial impact on shareholder value and employment

Europe’s economy is increasingly impacted by technology scale-ups. The international sway of these firms is yet to be determined, but at the very least, the profile of European capital markets and employment is set to be shaped by scale ups.

European unicorns — public and private — founded since 2010 are growing rapidly in value led by household names such as Adyen ($93bn), Klarna ($46bn), Spotify ($46bn) and UiPath ($30bn). 166 such companies sum up in value to €800 bn, or 2.5x the entire German car industry (7):

* As of 24.08.2021; Source: GB Bullhound, Pitchbook

Today, more than 2m people work for a European startup. While it’s still a small percentage of the total work force, these jobs are attractive, well paid, and the number is growing. In Germany alone, employment in startups has risen 55% since 2018 to 415,000. Employment in DAX companies, while still larger, has declined in the same period (8). Working for a tech startup is no longer an oddity, or the preserve of a select entrepreneurial class: it is the new normal for a growing proportion of the labour market.

European scale ups are already of vital importance for investors, consumers, and all levels of the labour market. If Europe is to avoid falling behind the US and China as regards stock market capitalization, economic growth and desirable employment opportunities, technology scale-ups will have to play an even bigger part. While many of the right ingredients are in place, more private capital will need to find its way into startups for Europe to emerge on top.

Author: Roland Dennert

(1) https://www.economist.com/leaders/2021/06/05/the-new-geopolitics-of-global-business

(2) The Economic Impact of Venture Capital: Evidence from Public Companies, Will Gornall and Ilya Strebulaev

(3) Employee Retirement Income Security Act

(4) https://companiesmarketcap.com/tech/largest-tech-companies-by-market-cap

(5) https://www.rolandberger.com/en/Insights/Publications/Scale-up-Europe-Building-Global-Tech-Leaders-in-Europe.html

(6) GP Bullhound — Titans of Tech 2021: Pandemic Proof

(7) GP Bullhound — Titans of Tech 2021: Pandemic Proof

(8) Roland Berger — Für ein deutsches Wirtschaftswunder 2.0